Portico Connected Series 5: Amid the Giants: The Enduring Appeal and Strategic Imperative of Niche Streaming Services

Portico Connected: Where Media, Technology, Culture and Content Converge

Bridging the realms of media, technology, culture, and content, Portico Connected is a blog series that offers incisive insights into the ever-evolving global media and entertainment industry. The platform serves as a gateway to the latest trends, groundbreaking innovations, and critical conversations shaping content creation, distribution, and consumption today. Offering unique perspectives from a quartet of industry powerhouses—GagaOOLala, a pioneer in LGBTQ+ streaming and digital media; Portico Media, Taiwan’s leading expert in pay-TV content and channel aggregation; GOL Studios, a production force with hundreds of captivating original titles; and HahaTai, a defining force in Taiwan’s contemporary social media zeitgeist—Portico Connected fosters dialogue and connections between industry leaders, creators, and audiences, exploring the multifaceted ways in which media unites us all in the digital age.

The streaming landscape has become a battleground of titans, with major players like Netflix, Disney+, and Amazon Prime Video vying for global dominance. Yet, amidst this clash, a new breed of streamer has emerged and is thriving: niche streaming services. Defined by their specialized content and targeted communities, these services are playing an increasingly crucial role in the complex streaming ecosystem, offering unique opportunities for content creators, production houses, and media companies. As the world’s premier streaming platform specializing in LGBTQ+, Boys’ Love (BL), and Girls’ Love (GL) content, GagaOOLala understands firsthand the unique opportunities and challenges faced by niche services. The following article delves into the rise and survival of niche streamers, exploring their strengths, challenges, and potential future, while showcasing GagaOOLala’s expertise and strategic positioning within this dynamic market.

The Ascendancy of Niche: Responding to Fragmented Audiences

The dominance of mega-platforms, with their broad content libraries, initially seemed to overshadow the potential of specialized streaming services. However, a significant shift has occurred. Consumers have begun seeking more specific content, gradually moving away from the "one-size-fits-all" approach. This has created a void that niche streamers have quickly filled, offering curated content that catered to specific interests, from anime and horror to British dramas and LGBTQ+ stories. As per The Streamable, niche streamers like AMC+, MGM+, and Shudder have experienced substantial growth, with a 400% increase in subscribers since 2019.

Specialty streaming stats from Antenna’s Q3’24 State of Subscriptions Report. Image Source: Antenna

These platforms, often driven by passionate communities, have carved their own paths by offering what larger platforms simply cannot: a deeply tailored viewing experience and a strong sense of belonging. This organic growth highlights the power of specialized content to resonate with specific, underserved audiences, fostering strong engagement and loyalty, driving subscriber growth, and attracting advertisers seeking to reach particular demographics. Key factors contributing to the success of niche services include:

Countering Content Overload: The dominance of "everything-for-everyone" platforms has created a demand for curated content experiences catering to specific interests.

Demand for Diverse and Specific Content: Audiences increasingly seek content reflecting their specific interests and cultural backgrounds, creating a demand for curated experiences.

Community & Belonging: Niche platforms often foster strong communities around their content, creating loyalty beyond mere entertainment.

Economic Efficiency: Operating with leaner structures and focused content strategies allows niche services to control costs more effectively than larger players.

Diverse and Untapped Audiences: These platforms serve specialized audiences often overlooked or underserved by generalist services, representing a unique value proposition.

The Tightrope Walk: Challenges to Niche Streamer Viability

The ascent of niche streaming, however, is not without its perils. The streaming landscape is fiercely competitive, and niche services must continually adapt and innovate to ensure their survival. Despite their passionate fan bases and focused approach, these platforms grapple with limited budgets, subscriber churn, the constant pressure to produce fresh, engaging content, and the daunting prospect of competing with giants that have enormous financial and marketing resources. To thrive, these platforms must adopt smart strategies that focus on cost-efficiency, lean operations, targeted marketing, strategic partnerships, and, most crucially, cultivating unwavering subscriber loyalty through high-quality, exclusive content. Critical challenges that niche streamers face include:

Resource Constraints: Compared to major players, niche streamers often have limited budgets and resources, making it difficult to compete on content acquisition and marketing.

Churn Pressure: Subscriber churn is a significant challenge, as consumers often subscribe to niche services for specific content and then unsubscribe once they've consumed it.

Competition from Larger Platforms: General entertainment platforms are increasingly incorporating niche content into their libraries, threatening the unique value proposition of specialized services.

Platform Dependence: Niche streamers, in their quest for discoverability and exposure, can be heavily reliant on streaming marketplaces (Amazon Channels) and their algorithms, making it difficult to build a direct relationship with users.

Pressure for Profitability: As the streaming market matures, investors are demanding profitability, putting pressure on niche streamers to demonstrate sustainable business models.

Weighted average monthly churn rate between Specialty vs. Premium SVOD services as per Antenna’s State of Subscription Report: Specialty Video. Image Source: Antenna

Subscriptions by Distributor breakdown between Specialty vs. Premium SVOD services as per Antenna’s Distribution Dynamics in Specialty SVOD. Image Source: Antenna

Case Studies of Success: Crunchyroll, Revry, and Shudder

Despite the challenges in the streaming landscape, several niche streaming platforms have defied the odds and achieved remarkable success. Examining their strategies offers valuable lessons for those seeking to compete in this challenging space:

Crunchyroll’s Immersive Ecosystem: The anime-centric platform’s journey from a niche interest to a global powerhouse exemplifies the strength of a focused content strategy and a deep understanding of its passionate community. Its diversified model, which includes theatrical releases, live events, and a robust streaming service, underscores the potential for specialized services to become major players in their respective domains. By focusing on exclusivity and leveraging Sony’s support, Crunchyroll has carved out a profitable, sustainable niche.

Revry’s Push for Authenticity and Diversity: As a pioneering LGBTQ+ streaming network in the USA, Revry’s success is rooted in its commitment to authenticity, representation, and fostering a sense of community. Revry’s focus on highlighting and elevating diverse queer stories and creators has created a loyal subscriber base and has attracted brands and advertisers seeking to connect with this influential audience. Its diversified “tribrid” model, combining subscription (SVOD), ad-supported (AVOD), and free, ad-supported (FAST) tiers, maximizes reach, engagement, and monetization opportunities.

Shudder’s Curation and Community: The horror-focused service has built a loyal following through a carefully curated selection of films and original programming. Its emphasis on community engagement and appointment viewing fosters a sense of belonging among horror fans. Shudder’s curated library of horror content, combined with exclusive acquisitions and community-driven initiatives like The Last Drive-In, has fostered a loyal fanbase. Its focus on boutique experiences and human-curated content differentiates it from algorithm-heavy competitors.

Case Studies of Challenges: CNN+, Viaplay, and MotorTrend+

While success stories offer inspiration, it is equally crucial to examine examples of setbacks. The following are select examples of niche platforms that struggled to achieve sustainability, illustrating some common pitfalls and the importance of strategic planning, market analysis, and efficient resource management for niche streaming services to succeed:

CNN+. Image Source: Gretchen Mayer

Viaplay. Image Source: Viaplay Group

Motortrend+. Image Source: Cord Cutters News

CNN+’s Strategic Mismatch: Launched with great fanfare, CNN+ was shuttered within weeks. The short-lived news streaming service failed to gain traction due to strategic misalignment with Warner Bros. Discovery's broader streaming strategy and a lack of clear differentiation, limited content appeal, and an ill-timed launch amid an already crowded news streaming market.

Viaplay’s Market Missteps: The Nordic streamer’s initial attempt to establish a direct-to-consumer presence in the U.S. market proved unsuccessful, illustrating the difficulty of expanding internationally and the importance of adapting to local market dynamics. As a result, the streamer opted for a strategic shift from a direct-to-consumer model to a third-party partnerships with Amazon Prime Video, Xfinity, Roku, Xumo, and Sling in the US, demonstrating the need for strategic flexibility and the value of leveraging existing distribution channels and networks.

MotorTrend+’s Lack of Scale: Despite being well-known in automotive circles, MotorTrend+ faced challenges in attracting a large enough subscriber base and was ultimately absorbed into larger platforms, Discovery+ and Max. The shutdown of this automotive-focused platform reveals the challenges of sustaining niche content within a purely subscription-based model, especially when facing competition from larger bundled offerings. The consolidation of its content within Discovery+ and Max highlights the potential for niche content to be absorbed by larger platforms, emphasizing the need for a diversified strategy.

Navigating the Future: What Lies Ahead for Niche Streaming Services?

The landscape of niche streaming is in constant flux, characterized by change and uncertainty. The future of niche streamers depends on their ability to adapt to the evolving market, as key trends will shape their trajectory in the coming years:

Market Fragmentation and Competition: The ever-increasing number of streaming options and services has created opportunities for niche services to cater to specific interests, but has also intensified competition.

Specialty SVOD share of Gross Ads as per Antenna’s Q3’24 State of Subscriptions Report. Image Source: Antenna

Industry Consolidation: As the overall streaming market matures, consolidation is inevitable. Smaller services are being acquired by larger players and merged with other niche platforms to achieve economies of scale and expand their reach toward specific demographics. For example, Sony’s purchase of the anime focused Crunchyroll illustrates the strategic value that such niche platforms bring. This trend presents both opportunities and challenges for independent niche services.

Sony Pictures X Crunchyroll’s Presentation at Cimenacon 2024. Image Source: Sony Pictures Life X

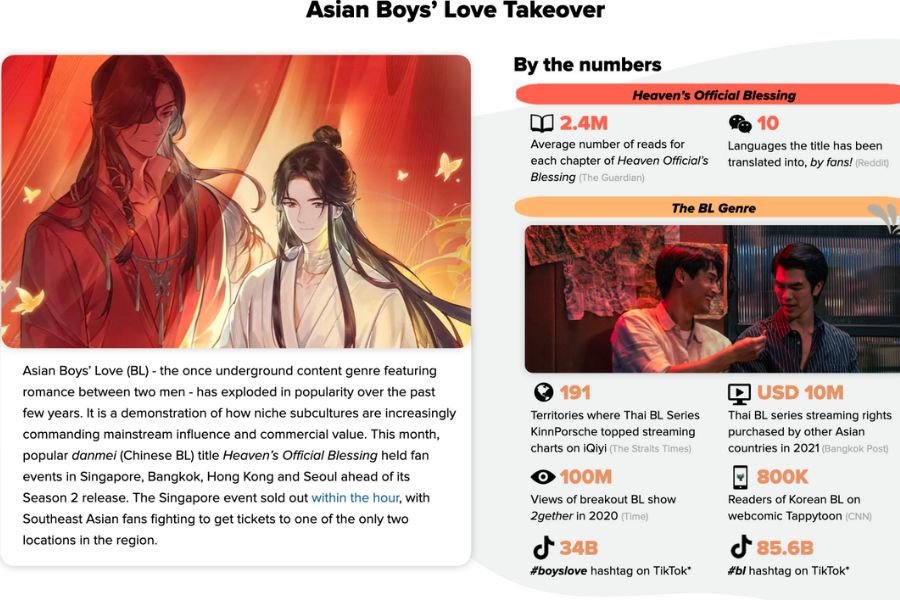

Integration of Niche Content into Larger Platforms: Niche content is also increasingly being integrated into larger streaming services, offering specialized programming within broader platforms. For example, this is evident in the wider availability and mainstreaming of BL, a relatively niche genre depicting male-to-male romance, across major streamers such as Netflix, Rakuten Viki, iQiyi, WeTV, and Viu.

The rise of Boys’ Love (BL) Genre from Asia. Image Source: Campaign Asia

In the wake of these changes and trends, the following are some key considerations and strategies that niche streamers need to keep in mind and consider implementing to ensure their survivability and long-term sustainability:

Cost Optimization and Effective Operations: Niche platforms must focus on efficient operations, low-budget production strategies, and the effective use of technology to offset the competitive disadvantages of bigger-budget rivals. They must strive to maintain lean budgets and maximize efficiency in content investments and outputs.

Data-Driven Decisions and Effective Churn Mitigation: Utilizing audience data to inform content curation and personalize user experiences can enhance subscriber engagement and reduce churn for niche streamers.

The Continued Rise of FAST: FAST channels provide niche streamers with opportunities to expand their reach and generate additional revenue. These channels offer a lower barrier to entry for viewers, making them an ideal platform for discovering and sampling new content.

Multi-Revenue Models: Besides FAST, by incorporating AVOD, TVOD, and live events into their operational strategy, niche streamers can diversify their income streams, reducing reliance on subscriptions.

Strategic Bundling and Partnerships: As the market becomes more crowded, niche streamers will need to explore strategic partnerships and bundling opportunities with larger platforms and brands. These collaborations can offer increased discoverability and access to larger audience bases.

Emphasis on Community and Engagement: The most successful niche platforms will continue to focus on building strong, engaged communities, using tools like social media, live events, and personalized recommendations to foster user loyalty.

Focus on Authenticity: Niche services must capitalize on their ability to offer targeted, authentic content that resonates with specific audiences to cultivate loyalty. This includes a diversity of voices, stories, and perspectives.

Global Reach and Localization: Niche streamers must tap into global markets to expand their reach and diversify their revenue streams. This includes focusing on localized content and cultural adaptation, creating programming that resonates with diverse audiences.

GagaOOLala: Your Partner in Niche Streaming Success

Amidst the David vs. Goliath dynamics within the streaming industry, it is clear that niche streamers will need to continue innovating and differentiating themselves to compete with the resources and scale of larger platforms. At GagaOOLala, we understand the intricacies of niche streaming. Our success as the world's leading LGBTQ+, BL, and GL streaming platform is a testament to our ability to cultivate a dedicated global community and deliver high-quality, culturally relevant content. Our expertise in content acquisition, production, distribution, and marketing, coupled with our understanding of global LGBTQ+, BL, and GL audiences, makes us the ideal partner for navigating the complexities of niche streaming.

GagaOOLala, The Global LGBTQ+, BL and GL Streaming Platform. Source: GagaOOLala

Through our experience and expertise in the niche streaming ecosystem, we understand that:

Audience Matters: Our deep connection to the global LGBTQ+, BL and GL community enables us to host and create highly engaging content that resonates deeply with our viewers, fostering loyalty and reducing churn.

Strategy Matters: We have adopted an efficient operational model focusing on cost-effective production, a data-driven approach, and have diversified our distribution across multiple platforms.

Partnerships Matter: We’re actively pursuing strategic collaborations with brands and technology providers that share our commitment to providing authentic and engaging content for the global LGBTQ+, BL and GL community.

Flexibility Matters: We understand the need for niche streaming services to balance unique offerings with the ability to adapt to emerging market trends like FAST channels, micro short dramas, social videos, and other forms of content distribution.

As we look to the future, GagaOOLala invites potential partners, directors, and brands to join us in creating impactful, diverse content that resonates deeply with our global audience. Together, we can build a vibrant, inclusive streaming ecosystem that celebrates stories often overlooked by the mainstream.

GagaOOLala: Where Niche Thrives, and Stories Connect.

GagaOOLala's Strategic Demographic Targeting

Portico Media Brand Portfolio

The Portico Media Global Entertainment Ecosystem

For more details, please access our Corporate Deck at: Portico Media Corporate Deck

For any questions and information, please contact: akash@porticomedia.com

Sources and References:

1) The Streamable, 14 September 2023. Specialized Streaming Services Continue to Grow Despite Crowded Market, but Will They Survive Age of Consolidation?

2) Antenna, 11 September 2024. Antenna Q3’24 State of Subscriptions Report: Specialty SVOD

https://www.antenna.live/post/antenna-q324-state-of-subscriptions-report-specialty-svod

3) Antenna, 13 September 2023. Antenna’s State of Subscription Report: Specialty Video

https://www.antenna.live/post/antennas-state-of-subscription-report-specialty-video

4) Antenna, 22 September 2023. Distribution Dynamics in Specialty SVOD

https://www.antenna.live/post/antennas-state-of-subscription-report-specialty-video

5) The Hollywood Reporter, 26 June 2024. Streaming Profits Are Tough to Find. Niche Movie and TV Platforms See a Way Forward

6) The New York Times, 13 November 2024. The Streaming Wars Didn’t Kill the Little Guys. In Fact, They’re Thriving.

https://www.nytimes.com/2024/11/13/business/media/hallmark-britbox-streaming-growth.html

7) dot.LA, 28 July 2020. Can a Niche Streaming Service Survive the Streaming Wars?

https://dot.la/niche-streaming-services-2646401314.html

8) TVREV, 31 August 2023. How Can Niche Streaming Services Survive? Four Top Analysts Have Some Ideas

9) tvtech, 18 October 2022. How Niche Streaming Platforms Are Innovating to Compete with the Behemoths

10) Variety Intelligence Platform, 16 August 2022. Why Niche SVOD and FAST Will Fuel Post-Pandemic Streaming Success

11) Variety, 21 February 2024. Sony’s Anime Streamer Crunchyroll Is a Rare SVOD Success Story

12) Streaming Media, 27 June 2022. How Revry Positioned a Niche OTT Vertical as the 'Global Face of Diversity'

https://www.streamingmedia.com/Articles/ReadArticle.aspx?ArticleID=153552

13) Deadline, 31 October 2023. Shudder Insiders Discuss How Niche Service Survives The Night Amidst Horror Story In Streaming

https://deadline.com/2023/10/amc-shudder-horror-streaming-service-success-2-1235589014/

14) Variety, 01 April 2022. CNN+ Is Shutting Down One Month After Launch (EXCLUSIVE)

https://variety.com/2022/tv/news/cnn-plus-shut-down-warner-bros-discovery-1235237913/

15) Variety, 17 April 2024. Nordic Streamer Viaplay Launches on Amazon’s Prime Video Channels in U.S., Following Shutdown of Its Own Service

https://variety.com/2024/tv/news/viaplay-us-launch-amazon-prime-video-channels-1235973818/

16) Deadline, 23 February 2024. WBD Shutting Down MotorTrend+ Subscription Service, Moving Its Content To Discovery+ & Max

https://deadline.com/2024/02/warner-bros-discovery-motortrend-streaming-discovery-max-1235835884/

17) The Verge, 25 January 2021. To all the streaming services you’ve never heard of before

https://www.theverge.com/c/22244771/streaming-services-niche-crunchyroll-ovid-acorn-tv

(This article represents a collaborative effort, integrating the advanced language processing capabilities of Google AI Studio and OpenAI's ChatGPT in its development.)